Tax returns show average income differences

By Kenneth Harwood

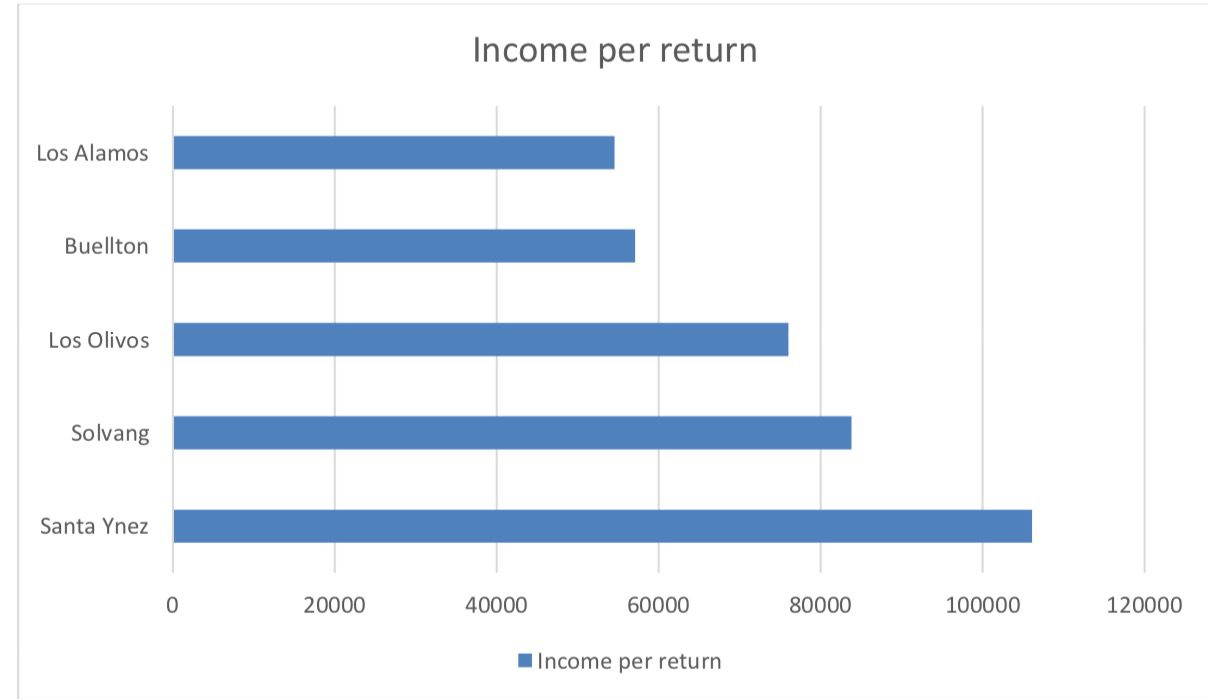

Five places in our local economic area show differences in average income, which is revealed by looking at taxable personal income, as reported by ZIP code.

The report comes from the California for the 2013 tax year. The bar graph displays average dollars of taxable income per return.

Income per return is just that. Some returns are for one taxpayer. Others are for two or more tax payers. Some people owe less or more than they should. Some taxpayers live alone, and some with others. The reported amounts are average dollars of Adjusted Gross Income (AGI) per return. AGI in California differs from AGI on federal income tax returns, because AGI is defined differently in the two jurisdictions.

Taxable personal income often is less than total income, for some income might be non-taxable.

We are able to see that average AGI per California tax return clearly differs between communities, each community being the ZIP code of one of the five places. And we know that AGI per return can and does differ within ZIP codes. Three tiers appear with Los Alamos and Buellton on the first level, Los Olivos and Solvang on the second, and Santa Ynez on the third.

Knowing AGI by community permits us to estimate where we might choose to live or to work. We are able to use AGI to help us to decide where the best customers are for a business, to plan advertising, to locate a retail business, and more.

Solvang has one ZIP code for street deliveries, and a second for deliveries to boxes in its post office. The two are combined in the graph.

Average dollars per return were calculated on information that can be seen online at California Franchise Tax Board, Economic Research Bureau. The site lists personal income tax statistics, number of tax returns filed, total dollars of adjusted gross income, and self-assessed tax process, in 2013 original returns, as of January 2014.

Kenneth Harwood is the economist for the Solvang Chamber of Commerce.