By Rodney Smeester

SYV Association of Realtors

It is a new year, so let’s take a moment to look back on how the Santa Ynez real estate market fared in 2018 and see what might happen in 2019.

The local real estate market in 2018 performed well, but later numbers from the last part of the year indicate a downturn in the market.

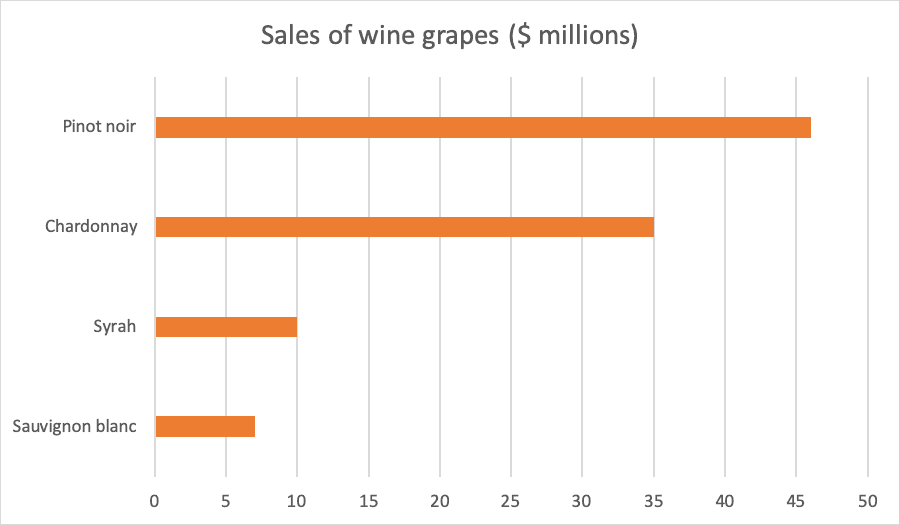

Sales and prices for all of 2018 were up significantly over the prior year, as shown in the chart, but the Santa Ynez Valley finished the year with a weak December and a weak fourth quarter.

It does appear that we are in the middle of a soft market, though the California Association of Realtors (CAR) is still forecasting price increases for 2019.

In December, sales of single-family residences in the SYV decreased to 13 units sold from 23 units sold in December 2017, down 43.5 percent. The median price decreased 12.8 percent from $790,000 to $689,000 while the average sales price increased 60.8 percent from $898,256 to $1,444,192.

The average sales price is an exception to other weak numbers in December. This exception is not an indicator of underlying strength. With the small monthly volume in the valley, the average price can increase dramatically with a single sale of a property worth $5 million-plus, without any change to the median sales price.

As a further sign of weakness for the month, the average days on the market (DOM) increased significantly, from 81 days to 123 days, up 51.9 percent. Not only were sale and prices down, homes were taking longer to sell than the previous December.

In the fourth quarter, sales in the valley decreased from 75 units in 2017 to 48 units in 2018, down 36 percent. The median price decreased 2.5 percent from $735,000 to $716.500 while the average sales price increased 7.9 percent from $933,638 to $1,007,243. The DOM confirmed the broad market weakness for the quarter in the Santa Ynez Valley. The DOM increased from 105 days to 159 days, 51.4 percent longer to sell on average, than in the fourth quarter of 2017.

Despite the weakness in the last several months of 2018, prices from year to year had solid appreciation. Sales volume was down considerably, but prices were still up. The SYV Association of Realtors recorded 280 single-family residences sold in 2018 compared to 328 units sold in 2017, a decrease of 14.6 percent. The SYV median price in 2018 was still up 6.3 percent from 2017. It increased from $740,500 to $787,500. The average sales price for the year was up 6.5 percent from $1,030,296 in 2017 to $1,097,419 in 2018. The DOM increased a marginal 1.4 percent, from 144 days in 2017 to 146 days in 2018.

In California, sales of existing single-family homes were predicted, as of October, to end the year down 3.2 percent and the median sales price up 7.0 percent in 2018. SYV did not do as well. Sales volume was down 14.6 percent and was reasonably close on median price performance, up 6.3 percent.

The differences between the state and Santa Ynez Valley numbers are within acceptable tolerances for a small market such as the Santa Ynez Valley. The 2018 SYV real estate market performed comparably, even though not precisely, to the California real estate market.

The SYV December and fourth quarter numbers indicate a market softening. The fact that the numbers for 2018 remain strong, only show that the first half of the year was quite strong, and the latter part of the year weakening was not severe enough to erase the earlier strength in the Santa Ynez market. Despite these solid numbers for the year, California and the Valley real estate markets have softened. What does that mean for 2019? Will they continue to weaken, remain soft, or was this just a short-term hiccup?

CAR forecasts that the state’s existing home sales will decrease 3.3 percent compared to 2018, and median sales prices will increase by 3.1 percent in 2019. Sales volume is expected to decrease while median sales prices are expected to keep increasing. Diverging statistics are usually an indication of a market in transition, but the stock market, even though it is off of its highs, is stable, and the economy is solid.

Local financial advisors are forecasting strong second- and third-quarter economic performance. Outside of a low California Housing Affordability Index, at 27 percent as of the third quarter of 2018, underlying factors remain strong.

One factor that could affect the real estate market are Federal Bank interest rate increases. Let’s hope they use discretion. The year may be starting as a soft real estate market, but forecasts indicate that it will end up being another solid year for California real estate.